Covid corruption

Even before the World Health Organization declared SARS-Cov-2 a global pandemic on March 11, biotech shares were treated to some serious gold rush fanfare. As recent as July, if the market was in trouble, all one needed for it reverse course was for some biotech company – Moderna, Gilead or CanSino Biologics – to release a statement of Covid-19 drug progress — and the market ripped higher.

Yet, biotech is not always gold dust for stocks: earlier this month, a Bill and Melinda Gates Foundation backed Covid vaccine maker, CureVac (CVAC), debuted on Nasdaq

Here’s a simple example from a retail investor’s point of view: If you had put $10,000 in the KraneShares China Healthcare Fund (KURE)

In the market, the debate is which companies are still worth owning. No one really understands the science, so they’re betting on timing and what little they can understand about the vaccine’s efficacy in their trial phases.

And the race is not just for vaccines, it’s for therapeutics as well. As world wide cases will pass 24 million this week, and likely today, effective cures are the key for healthcare, for the global travel and tourism, for business events, and for the general service industry. Both vaccines and FDA approved therapeutics would be a game changer worldwide.

Here is a look at some of the most popular stocks in the space, and a few of the up and coming ones, like Johnson & Johnson

$JNJ

Johnson & Johnson stocks skyrocketed on August 21 after Cramer’s comments questioning why it has not done so well versus other ‘race for the cure’ coronavirus trades. It’s up up around 26% since its March 23 low. Investors may just be warming up to this one because it’s expected to begin the advanced-stage trials for its coronavirus vaccine next month on some 60,000 volunteer patients.

The Janssen Pharmaceutical Companies of Johnson & Johnson are working with Emergent BioSolutions, Inc. (EBS) and Catalent Biologics (CTLT) to make its lead vaccine candidate. The same technology to make the vaccine was used to develop two million regimens of their European Commission approved Ebola vaccine and to make their HIV, RSV and Zika vaccine candidates.

EBS shares are up 129% year-to-date. CTLT is up 57%. All three of these stocks are now trading above their 200 day moving average as investors find a new fan fave in the vaccine hunt.

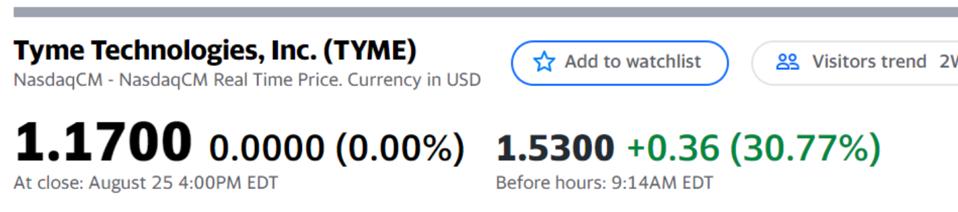

$TYME

A much smaller newcomer is Tyme Technologies (TYME). They are known primarily for cancer drugs, but they’re getting in on the coronavirus act as well. Their share price is down over 14% mainly because investors are piling into two types of biotech firms – anything China-related and anything Covid-related. They’re trading under their 200 and 50-day moving averages.

Might it be a find?

Their latest experimental drug, named TYME-19, is an oral synthetic bile acid that has shown to be effective against Covid-19 in preclinical studies. The trial is being developed with researchers from Massachusetts General Hospital and the Weill Cornell Medical Center. A proof-of-concept trial is slated to begin soon. And news of them getting in on the act sent their share price up 30.7% in the pre-market hours on Wednesday.

“I and a few other physicians I know have tried it and we have given it to a handful of patients and the results were encouraging,” says Dr. Curtis Cetrulo, a physician and senior investigator at the Transplantation Biology Research Center at Massachusetts General Hospital. “With any drug, we won’t know if it is actually effective until we study it in controlled clinical trials,” he says. “What is important right now is demonstrating an efficacy signal in a randomized clinical trial and then, I am guessing, all of the other pieces would come together as appropriate,” he says.

The company’s CEO, Steve Hoffman said in a press release that TYME-19 is actually related to their science for other cancer drugs and hopes that it “can soon be an important treatment alternative for doctors in the fight against Covid-19.”

Sometimes you win that fight, sometimes you lose it.

Gilead Sciences (GILD) was an early darling of the Robinhood biotech traders, the new name for retail traders hooked into the Robinhood stock trading app. It rose early because of its Covid-19 treatment remdesevir. Once that drug was approved for treatment by the FDA, investors sold and haven’t bought back since.

“It was a classic sell on the news,” Oppenheimer

$AZN

AstraZeneca (AZN) is one of the most talked about names in the coronavirus drug trade and for that reason, it is one of the most expensive biotech stocks around. They are down around 10% from their all-time highs of July 17. The stock is still trading over its 200-day moving average and has a multiple of 69 times trailing twelve month earnings.

As a company, AstraZeneca is one of the leaders in the vaccine race. They are working with Oxford University on one of the most advanced late stage vaccine trials everyone is hopeful will do the trick. They signed a deal in mid-August with the EU to supply 400 million doses of the vaccine.

Their drug, called AZD1222, is currently being evaluated in a phase II/III studies.

$MRNA

Moderna (MRNA) was everyone’s favorite, but has lost its momentum. The stock has declined since July 17, though anyone who got bought early in the biotech gold rush is up three fold. Moderna shares are up over 220% over a 6 month period and year-to-date. Some profit taking is only warranted at this point.

Moderna is nearing a deal to supply vaccines to the European Union, and while the market is a bit worried about President Donald Trump’s new plan to tackle the coronavirus through blood plasma from those who already had the virus, Moderna’s vaccine is still seen as a potential solution.

$PFE/$BNTX

Pfizer

The Pfizer/BioNTech partnership is now a full month into their phase II and phase III studies inoculating 30,000 volunteers aged 18 to 85 in the U.S.

Pfizer said they will add around 120 sites globally for their RNA-based coronavirus vaccine.

Emerging Markets/Emerging Solutions

The two emerging market players here are CanSino Biologics and – says Siddharth Singhai, CIO of Ironhold Capital – Cipla. They’re not listed here.

CanSino is a Canada-China partnership. They are likely to have the most trusted vaccine in Asia. It will also be more trustworthy than the one coming out of Russia, which did not have a recognized, state-of-science clinical trial.

$CASBF

CanSino is a Hong Kong stock, and has shares listed over the counter here under the ticker CASBF. The China retailers love it. It is up a whopping 248% in dollar terms so far this year, making it the Moderna of Asia. It is losing some trading momentum, which is good for those who want to get in on the leader in the race for a SARS-CoV-2 solution in China. The stock closed the day 1.8% lower in Hong Kong today.

Their Ad5-nCoV vaccine is being used by China’s military currently and further late-stage trials are being lined up for Mexico, Brazil, Chile and Saudi Arabia. Russia is currently testing it, Reuters reported. The vaccine was patented in China on August 17.

$CIPLA

The only problem with India biotech is that everyone is in India biotech, so investors have to dig or risk paying too much. Ironhold Capital fund managers likes Cipla out of all of them.

For retail traders, they can access Indian stocks through Interactive Brokers. Or they can try their luck with Dr. Reddy (RDY). Cipla and Reddy are tracking each other on a stock chart.

Cipla shares are up 57% year-to-date in rupee. RDY is up 48% in dollars. Their price-to-earnings are about the same and both are trading over their 200-day moving average. Ironhold Capital says Cipla is a buy because it is the only company to supply both Favipiravir and Remdesivir – both in use in early phase treatment in India hospitals. “Cipla is India’s lowest cost producer of the latter,” says Singhai about remdesevir. “Cipla is really promising in the short-term, being well positioned in this virus economy and situated to provide millions with medicine as Covid cases continue rising across India,” he says. “In all likelihood, the demand for coronavirus medication will decline once a viable vaccine is developed. Cipla has good fundamentals, and a return on incremental invested capital of almost 100%, so the company will be able to use its revenue boost and grow beyond this current boom in demand,” Singhai thinks.

India is the third hardest hit country in the ongoing global pandemic. It has not yet hit peak coronavirus.

Almost 800,000 people around the world have already died from Covid-19, according to the latest tally from Johns Hopkins University. CureVac investor Bill Gates is saying “the worst is still ahead”. He says the death toll will ultimately rise “by millions.”

Many scientists believe a vaccine will be ready before another million people die.

Therapeutics may also provide a complimentary a solution in the meantime.

“Our objective with (therapeutic drugs) is to treat patients sufficiently early in their disease before they need hospitalization in order to prevent hospitalization,” says Cetrulo, who is leading a trial for TYME-19. “There is no scientific reason why you couldn’t treat later stage patients as well, and that could be a good follow-on clinical trial, but right now there is a real gap for what we can use to treat patients before hospitalization. Most of those patients are just being sent home and then we focus on the patients whose symptoms become potentially life threatening,” he says.

Tommy Thompson, former head of Health and Human Services under George W. Bush and ex-Tyme board member said there are still no approved (therapeutic) drugs for SARS-Cov-2, although the FDA has a few Emergency Use Authorizations.

“Nothing has changed in what it would take to get a drug approved by the FDA – proven safety and efficacy – they are just trying to do it faster,” Thompson says. “If a drug is safe, like TYME-19, you would want to give it to patients before they are in a life threatening situation.” He says companies need to make a therapeutic that can work on a lot of viruses besides Covid. “That’s the type of drug we need on the market so that we don’t go through another year like 2020 waiting for drugs to be developed in the next outbreak,” Thompson says.

None of these biotech firms have the magic cure yet. But many investors believe so long as the coronavirus is an issue, the companies looking for fast, cost effective and safe solutions to the crisis will be the ones to get their money.

Follow me on Twitter or LinkedIn.

Comments

Post a Comment